Contact your local Community Action Agency to learn more about or to apply for:

-Electric Assistance

-Fuel Assistance

-Weatherization Assistance

Community Action Program, Belknap and Merrimack Counties

603-223-0043

Thanks to Darlene at Deer Meadow for starting the neighborhood Facebook group.

Due to the number of spam phone calls, a number of residents asked for the phone number used when the automatic call list is activated. The caller ID will display 1-877-698-3261, which is the toll-free number for One Call Now.

The information below is from a trusted source about rental assistance. There may be a time when the car breaks, the heater burns up and COVID-19 hits the world! If you qualify, these programs are available to assist people with their rent and relieve some of the stress of life. Most vouchers need to be signed by the landlord, please contact Stacey 603-746-3600.

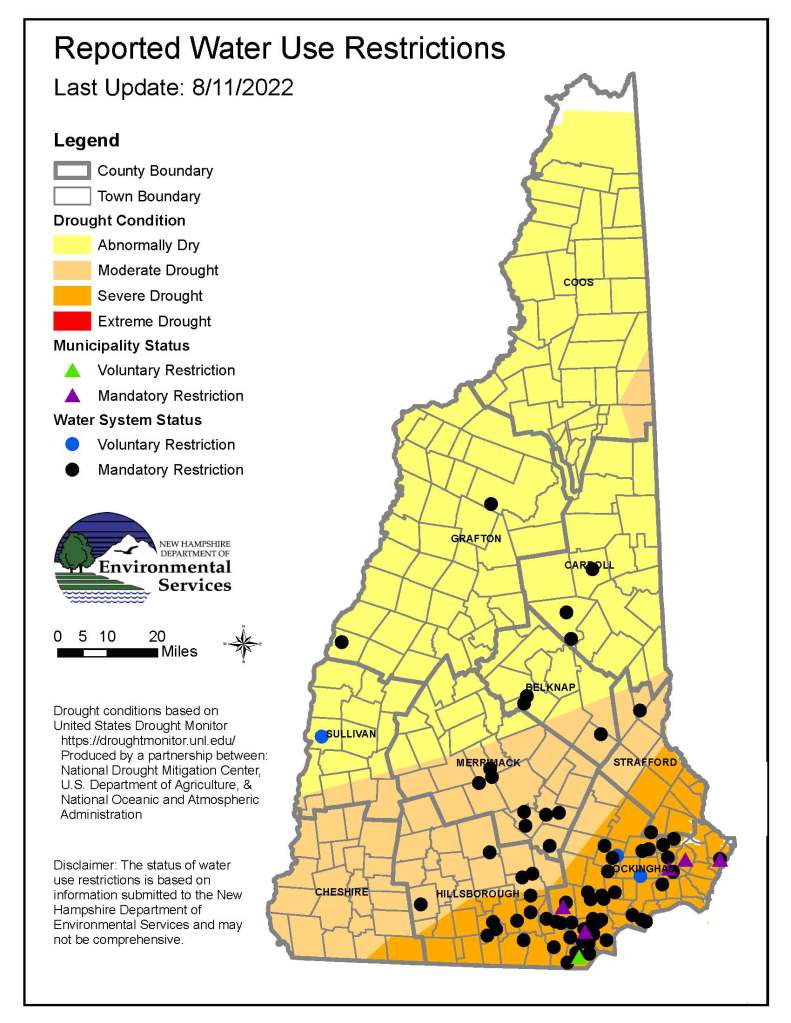

Please discontinue all outside sprinkler use. Hand watering with a hose is allowed for plants and gardens.

Please do not wash cars, houses or driveways. If you plan to pressure wash your house, please call first for an approval, depending on drought conditions.

August 24, 2022 Updates to follow

https://www.des.nh.gov/sites/g/files/ehbemt341/files/documents/water-restrictions-list.pdf

https://www.des.nh.gov/climate-and-sustainability/storms-and-emergencies/drought

Here is a list of local banks with mobile home financing:

Please contact Stacey if you know of other available options.

Concerns about HEAT TAPE…. the present one has been installed for years and no one knows how long it will last. Don’t wait until a pipe freezes, check it TODAY!

A fellow resident suggested this easy way to test your heat tape…

Open access to under you house to reach the heat tape wrapped around the main water supply.

Leave your hand exposed until it is real cold then grab around the insulated heat tape.

If it is warm the heat tape is working!!

The Town of Hopkinton has adopted an Elderly Exemption program. If qualified, the exemption is subtracted from the property assessment. The exemption for those who qualify is:

Applicant must fill out an Elderly Exemption Worksheet, covering the full calendar year preceding April 1st, along with a PA-29 “Permanent Application for Property Tax Credit/Exemptions”, sign, date and submit to the Assessor’s Office.

Elderly Exemption Eligibility Requirements

Income qualifications will include any income from all sources in the calendar year proceeding April 1st.

Asset qualifications will include any assets on the date of application

Assets not to exceed $150,000 (excluding the home in which they reside)

The following documents will be required to verify eligibility: (Please bring documentation with you when applying.)

All documents and copies of documents submitted with or requested to verify an application for a property tax credit, exception, or deferral are considered confidential and returned to the applicant after a decision is made on the application.

You must be logged in to post a comment.